If you’re based in California or sell to customers based in California and are considering offering gift cards, it’s important to understand the state’s specific laws (that are typically more stringent than US federal law) to avoid costly penalties.

For example, California law prohibits expiration dates on most gift cards and businesses are legally required to redeem gift cards for cash if the amount left on them is less than $10. Non-compliance can lead to legal action, bad reviews and damage your brand’s reputation. California regulations don’t differentiate between digital or physical gift cards, and you should assume any laws apply in both cases.

While we do our best to ensure the information below is accurate and up to date, it’s important to understand this is not legal advice and intended as a general guide only.

We break down the regulations to ensure your business stays compliant and protected. Here’s what we’ll cover:

The most important things to know

Penalties for non-compliance

Federal Law vs. California Law

Cardivo: a compliant gift card solution for businesses

A step-by-step guide to offering gift cards using Cardivo for your business

The most important things to know

Here are the must-know rules for businesses based in California or selling to California residents:

Expiry dates

Under California law, gift cards can’t have expiry dates, with a few exceptions:

- Gift cards issued from loyalty, award, or promotional programs where no money or other thing of value is given in exchange – eg: if a customer makes 10 purchases and as a result is issued a $10 voucher, it can have an expiry date

- Gift cards used at multiple, unrelated sellers

- Cards issued in lieu of refunds for returned merchandise

- Gift cards sold in bulk below face value to an employer with a volume discount or those sold or donated to nonprofits below face value (as long as they expire within 30 days of sale)

- Gift cards for perishable food products.

For these exceptions, the expiration date must be printed in 10-point capital letters on the front. For digital gift cards, it must be clearly stated wherever the gift card is visible in emails or web pages.

A gift card without an expiration date is valid until it’s redeemed or replaced.

If you’re a business offering your own gift cards redeemable at your business, the exceptions above mostly don’t apply and you should ensure there are no expiry dates or periods on any gift cards you sell. This is easily done when using a modern gift card tool like Cardivo which lets you offer gift cards with no expiry dates with one click – we’ll explore Cardivo as an option a bit more later.

Service fees

California prohibits businesses from charging any service fees on gift cards. This means no inactivity fees, maintenance fees, or any other types of charges that reduce the card’s value. So if someone buys a gift card for $500, then the recipient must get the full $500 without it being eroded over time. Businesses are also not allowed to charge any ongoing or maintenance fees that eat into the balance – like a monthly fee, a fee for inactivity, reloading, or balance inquiries. The only exception is if a gift card has less than $5 in value and hasn’t been used for 24 months. In that case, a dormancy fee of $1 or less per month can be charged.

This is separate to any payment processing or other fees you might charge the buyer of the gift card upfront though. There is no specific regulation prohibiting that. If you’re selling gift cards and want to cover the service provider and payment processing fees, you can just add that on and charge it to the buyer upfront when they purchase the gift card.

Cash redemption

According to California Civil Code Section 1749.5(b)(2), if someone has a gift card with a remaining balance of less than $10, they have the right to redeem it for cash upon request. This means businesses are legally required to provide cash (physical cash, check or bank transfer) for the remaining balance when asked. Typically this would happen if a customer has redeemed their gift card at your business for something close to the full balance, but has a small remaining balance. It is illegal to refuse such a refund under California law and recipients can report the violation to the California Department of Consumer Affairs or the Attorney General’s Office. They can also take legal action, which may include filing a complaint or seeking remedies through small claims court.

Refunds

There is no specific legal obligation to provide buyer of gift cards refunds for their gift card purchase. The only exception would be covered by general consumer law if you are unable to provide the products or services the gift card should be redeemable for.

Disclosure Requirements

California law mandates that businesses clearly explain all the terms related to gift cards. This includes informing consumers about expiration dates (if applicable), fees, and redemption policies. A modern gift card tool like Cardivo makes it easy to convey these disclosures and make the buyer and recipient of gift cards aware of all relevant terms and conditions.

Bankruptcy

Gift cards do not lose value automatically when the seller declares bankruptcy. Under a recently adopted law, the seller must honor gift certificates issued before the date of the bankruptcy filing. Sellers aren’t required to redeem them for cash, replace lost or stolen gift cards, or maintain separate accounts for the funds but they must continue to honor gift cards even after filing for bankruptcy. However, the effectiveness and enforcement of this has not been tested meaningfully.

Sellers filing a “Chapter 11” bankruptcy, intending to stay in business, typically seek permission to honor gift certificates to maintain good customer relations and protect their brand.

If the court denies this or the seller files a “Chapter 7” bankruptcy, gift certificate holders are creditors with high priority among unsecured creditors in a Chapter 7 case. They may receive a percentage of the certificate’s or card’s value if the bankruptcy estate has enough assets to pay claims.

This archive copy of FAQs and Tips on Gift Certificates and Gift Cards from the California Department of Consumer Affairs (as of September 2024) contains more detail. We’ve referenced this pdf because the live link stopped working in November 2024 and leads to a broken page.

Penalties for non-compliance

Consumers can file a complaint with the California Attorney General’s Office or their local district attorney’s office if they believe a business has violated gift card laws. These offices can investigate the complaints and take legal action against those found guilty.

Businesses that violate these rules may face hefty fines, sometimes reaching millions of dollars. Other penalties could include lawsuits, restitution to affected customers, and damage to their reputation.

Take Home Depot, for example. The retail giant recently faced $750,000 in penalties for violating California’s law on gift cards. Similarly, fast food chain Taco Bell paid $85,500 after refusing to cash out gift cards valued at less than $10.

Federal Law vs. California Law

The federal government also started enacting laws for gift cards, but there are some key differences between federal and California law. For example, under federal law, gift cards are protected by a five-year expiration period, and no fees can be charged during the first year after purchase. In this regard, California law offers better consumer protection, with no expiration dates allowed on gift cards (with some exceptions).

Federal law can sometimes preempt state law if there are inconsistencies, but specifics for exemption haven’t been fully established. When inconsistencies appear, the general rule is to give precedence to whichever protects consumers the most.

You can see here a detailed comparison pdf between US Federal and California Law from the California Department of Consumer Affairs.

Cardivo: a compliant gift card solution for California-based businesses or businesses selling to California residents

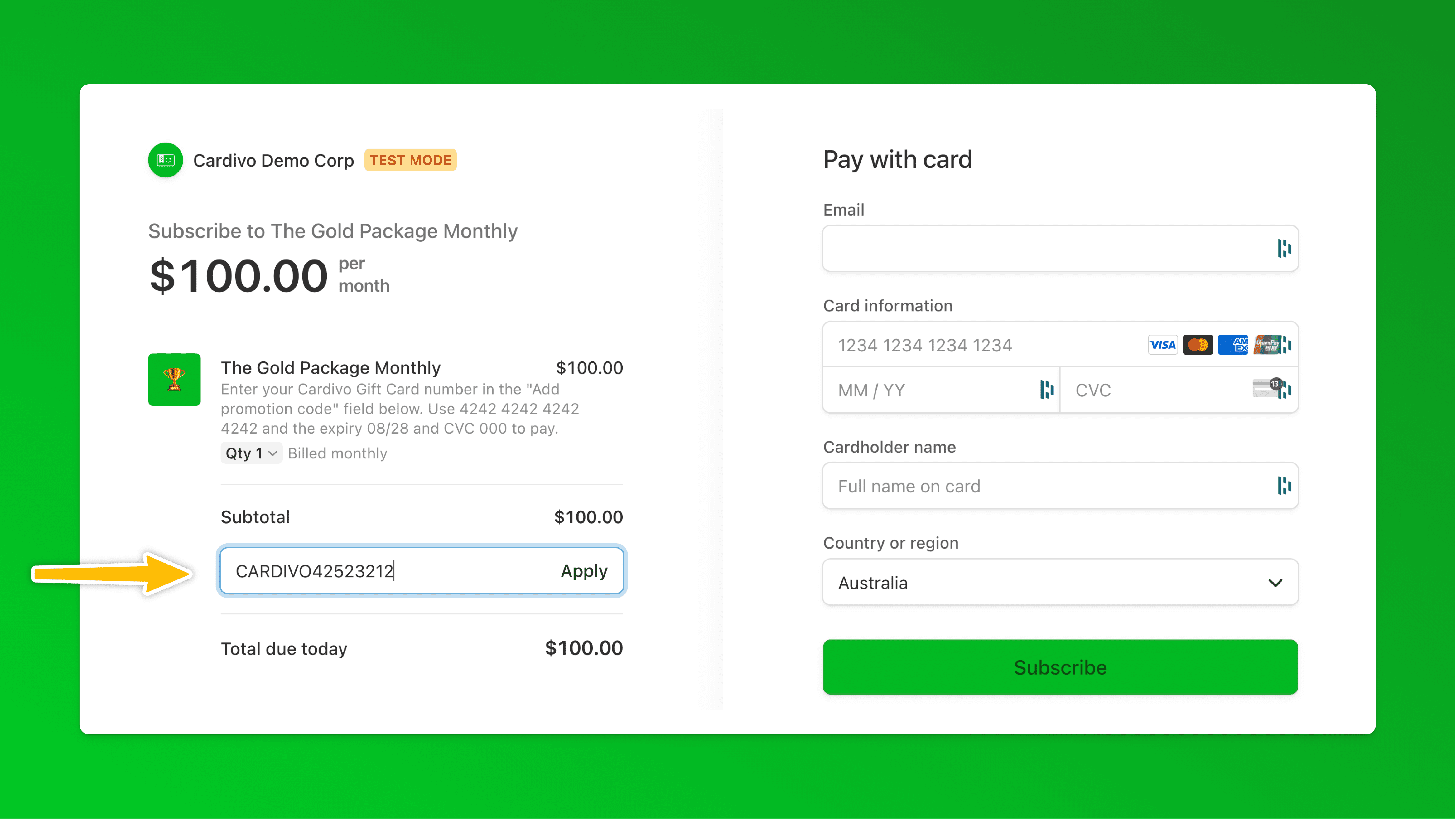

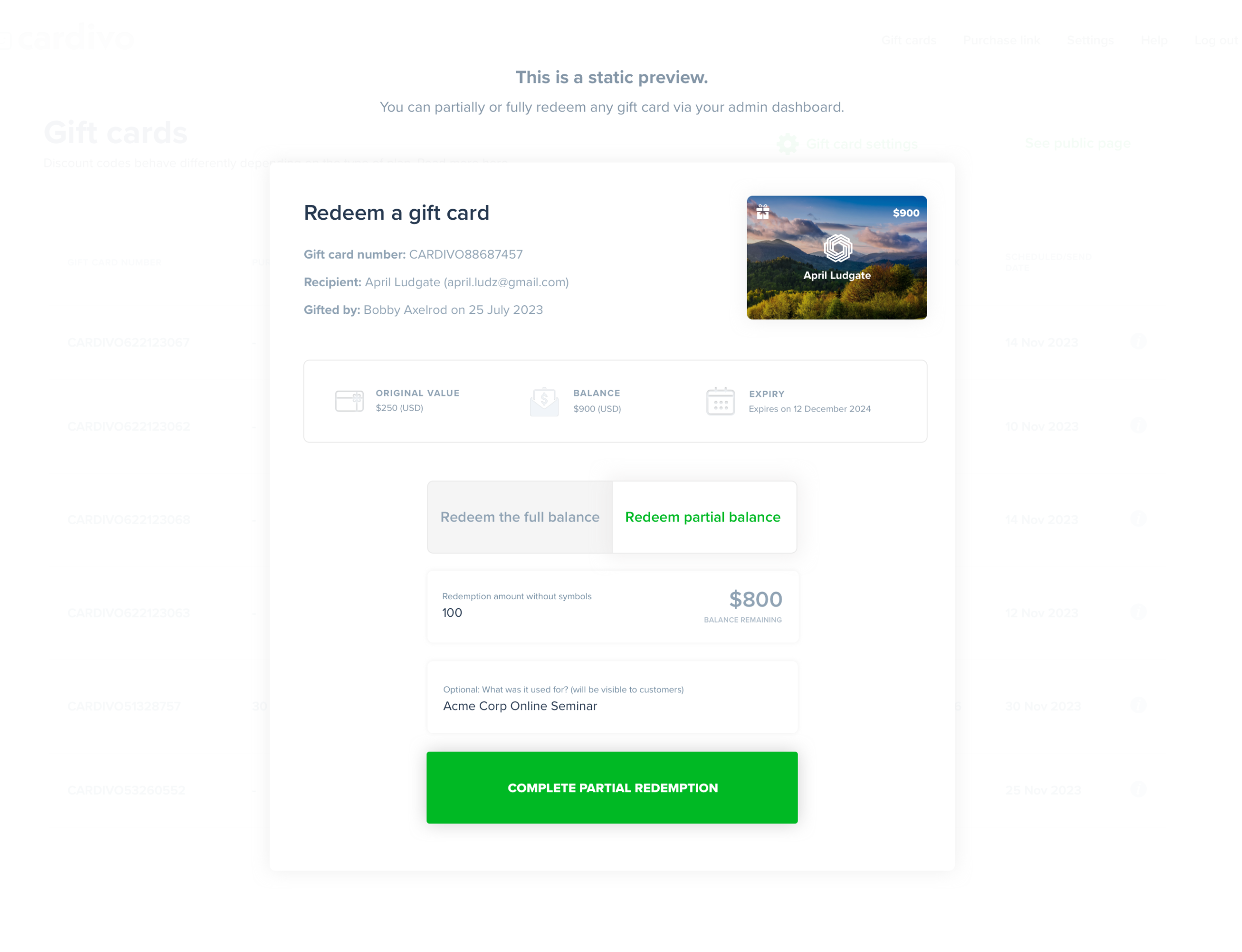

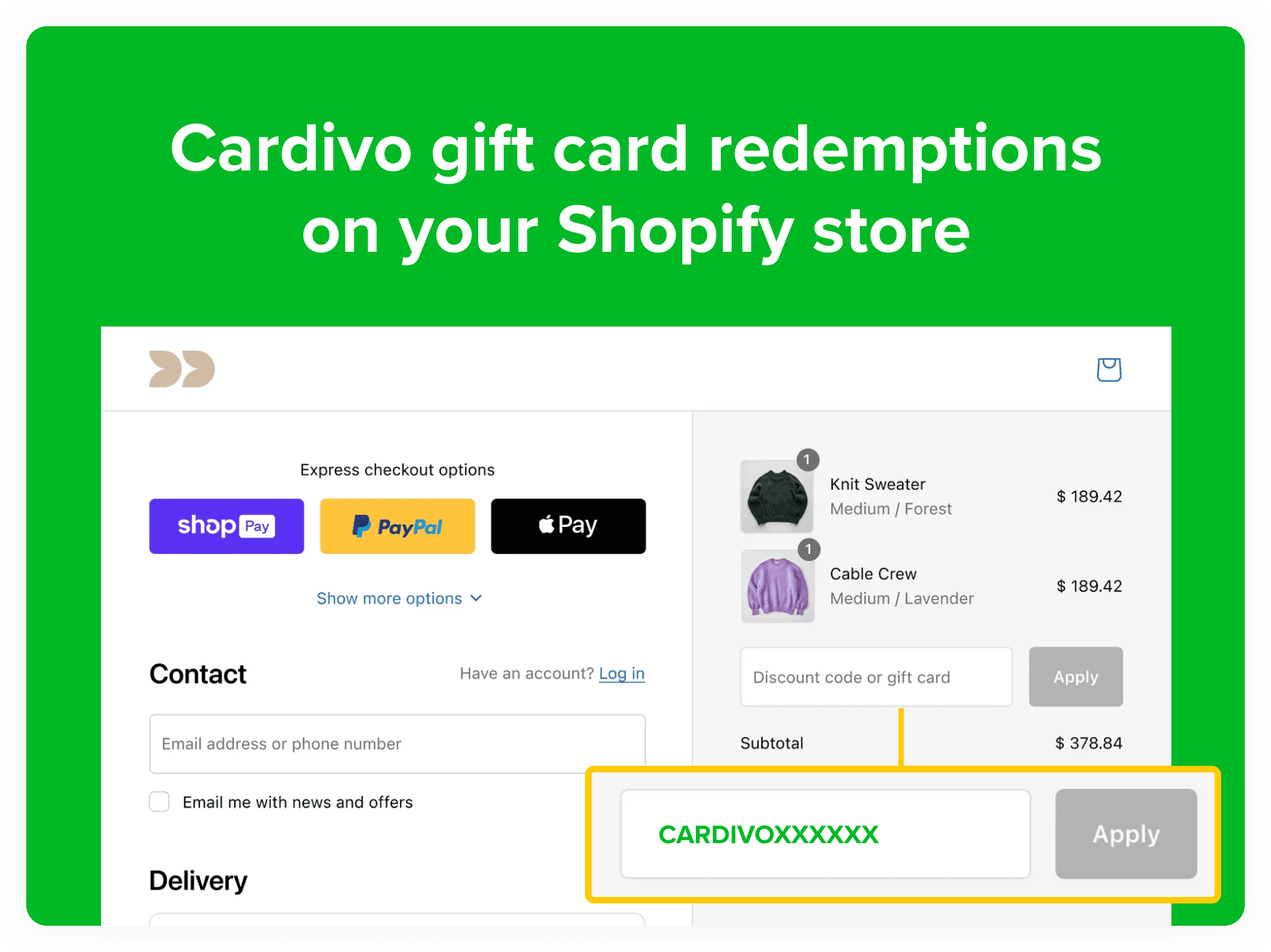

Cardivo is a digital gift card platform that helps California-based businesses or anyone selling to California residents stay compliant with state and federal laws. Here’s how it supports your business:

- Toggle off expiration dates: In your Cardivo dashboard, you can choose to have no expiry date for your gift cards which makes it easy to stay compliant with this legal requirement. This is also the case in some other countries plus customers prefer it so we generally recommend having no expiry date.

- Transparency: Businesses using Cardivo can easily customize their gift cards to include essential information like terms and conditions, fees, and redemption policies, keeping them compliant with the law. You can get buyers of gift cards to agree to these terms before they buy. And these terms are visible and accessible to gift card recipients at all times on their unique gift card page, ensuring your terms are always clearly communicated.

- Cardivo also has a dedicated section where you can add clear instructions for how and where a gift card can be redeemed – this is included in the original email sent to the recipient and is available to them via their gift card link. This ensures gift card recipients always know where and how to use their gift cards.

And there’s more:

User-friendly and easy to use

You don’t need any technical expertise to use Cardivo. Its intuitive interface allows you to offer and manage your gift cards efficiently. It takes under 10 minutes to get started. The same ease of use extends to those buying or redeeming your gift cards. It just works.

Engage customers and increase sales

Offering a gift card program that mostly runs on autopilot gives you another channel to engage with your existing customers and helps them share your business with their friends and family. This helps you sell more to existing customers as well as new customers that receive gift cards. It’s an easy and often underlooked way to increase sales, in almost any type of business.

Automated everything

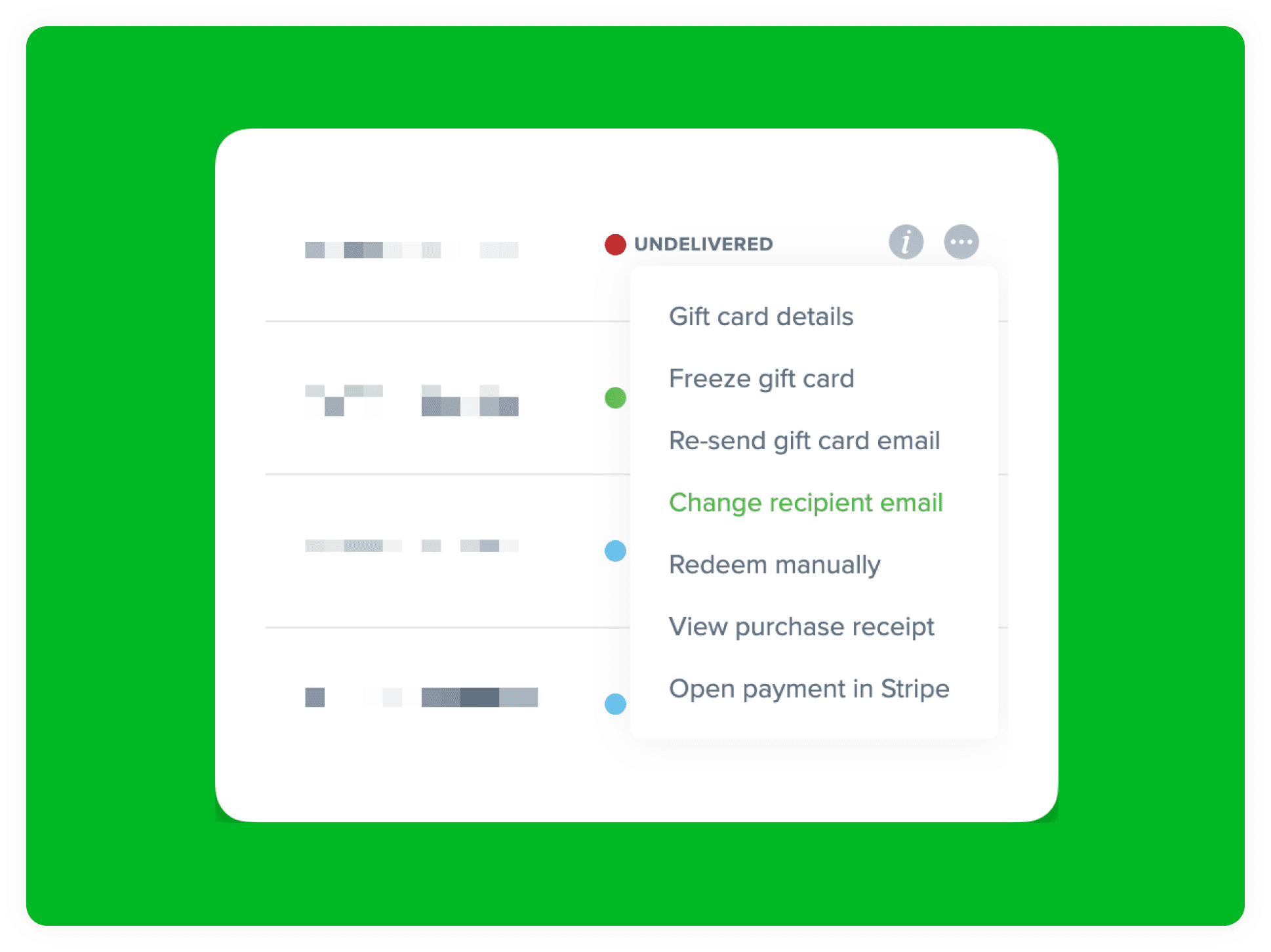

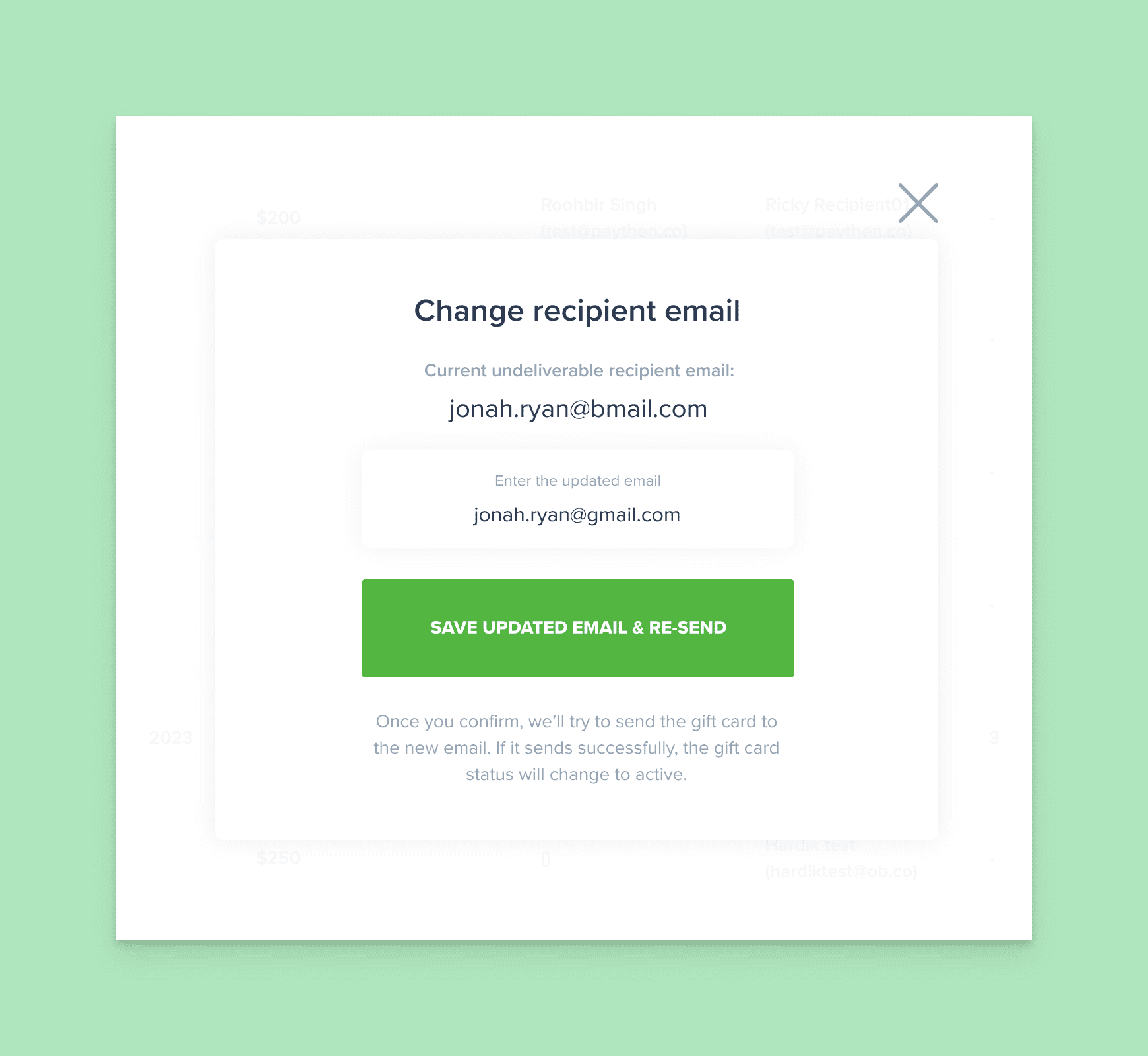

Cardivo handles your entire gift card program from the gift card purchase, through to gift card delivery and redemption, sending relevant emails to buyers and recipients, providing receipts, and a dedicated gift card page where recipients can manage their gift card easily. In most cases, there is no manual intervention or additional admin needed, you just set it up and promote it on your site and other channels and see the sales rolling in.

Your data is secure

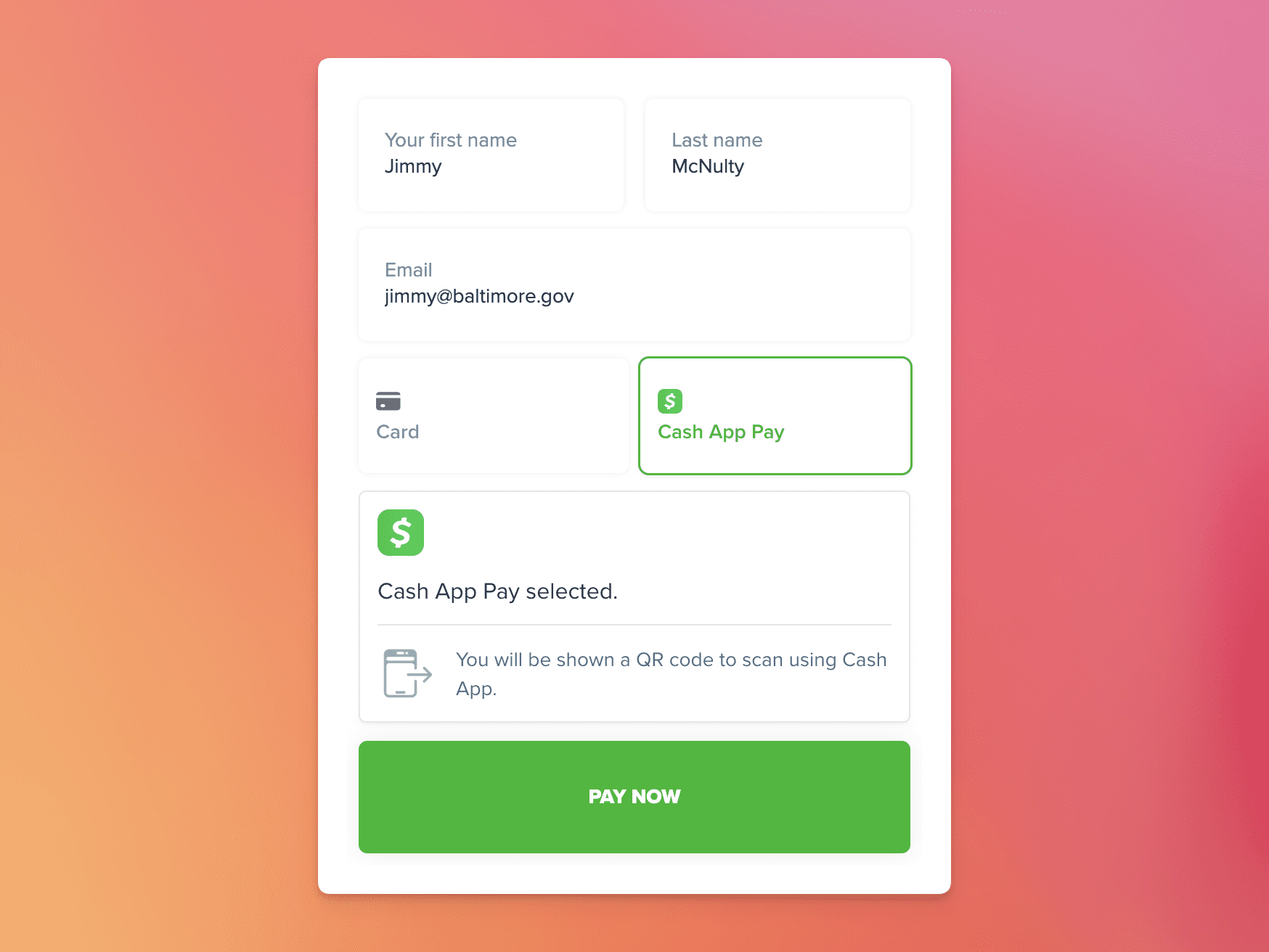

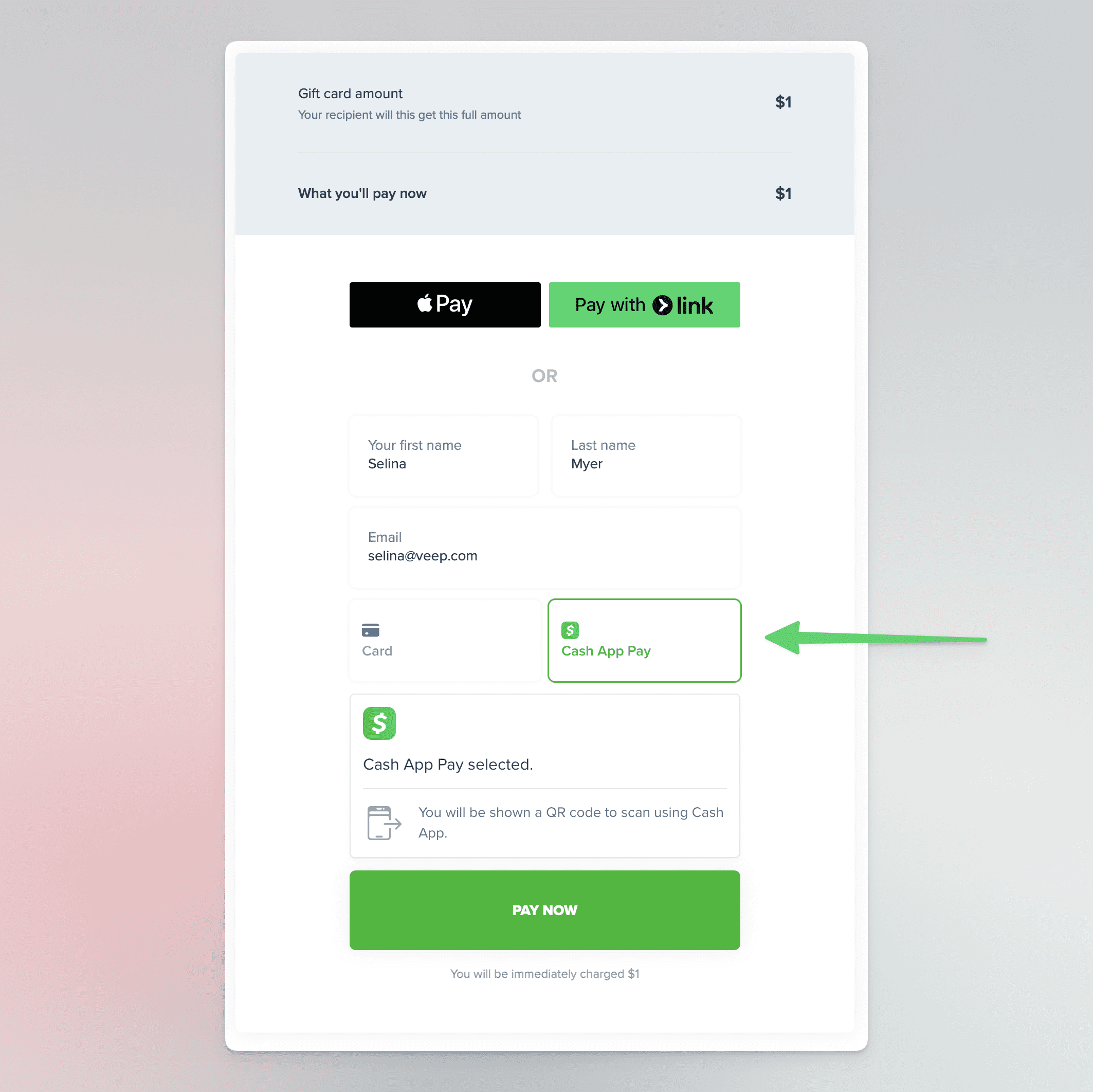

Cardivo prioritizes the security of customer information so that all transactions are safe and secure. All payments are processed through Stripe, one of the world’s leading and extremely secure payment processors.

There’s no setup fee, fixed fee or lock-in. You also don’t need a credit card.

Cardivo is free to set up and use. We just charge one fee – a low 5% of any gift card sale made through our platform. You can even pass this on to gift card buyers easily.

A step-by-step guide to offering gift cards using Cardivo for your business

It’s easy and free to get started with your gift card program using Cardivo. Here are the exact steps:

1. Create your free Cardivo account here

2. Connect your Stripe account (or create a new one)

Connect Cardivo with your Stripe account. If you don’t have an account, you can create one easily in a few minutes for free. Stripe is the payment processor we use and one of world’s best payment processors used by millions of businesses.

3. Choose your gift card sales page link

Set your sales page link—the URL where customers can purchase your gift cards. You can change this link at any time. We recommend using your business name to customize it.

4. Now configure some basic settings, choose the designs you want and if you’re in California or selling to californians, don’t forget to keep that expiry date off

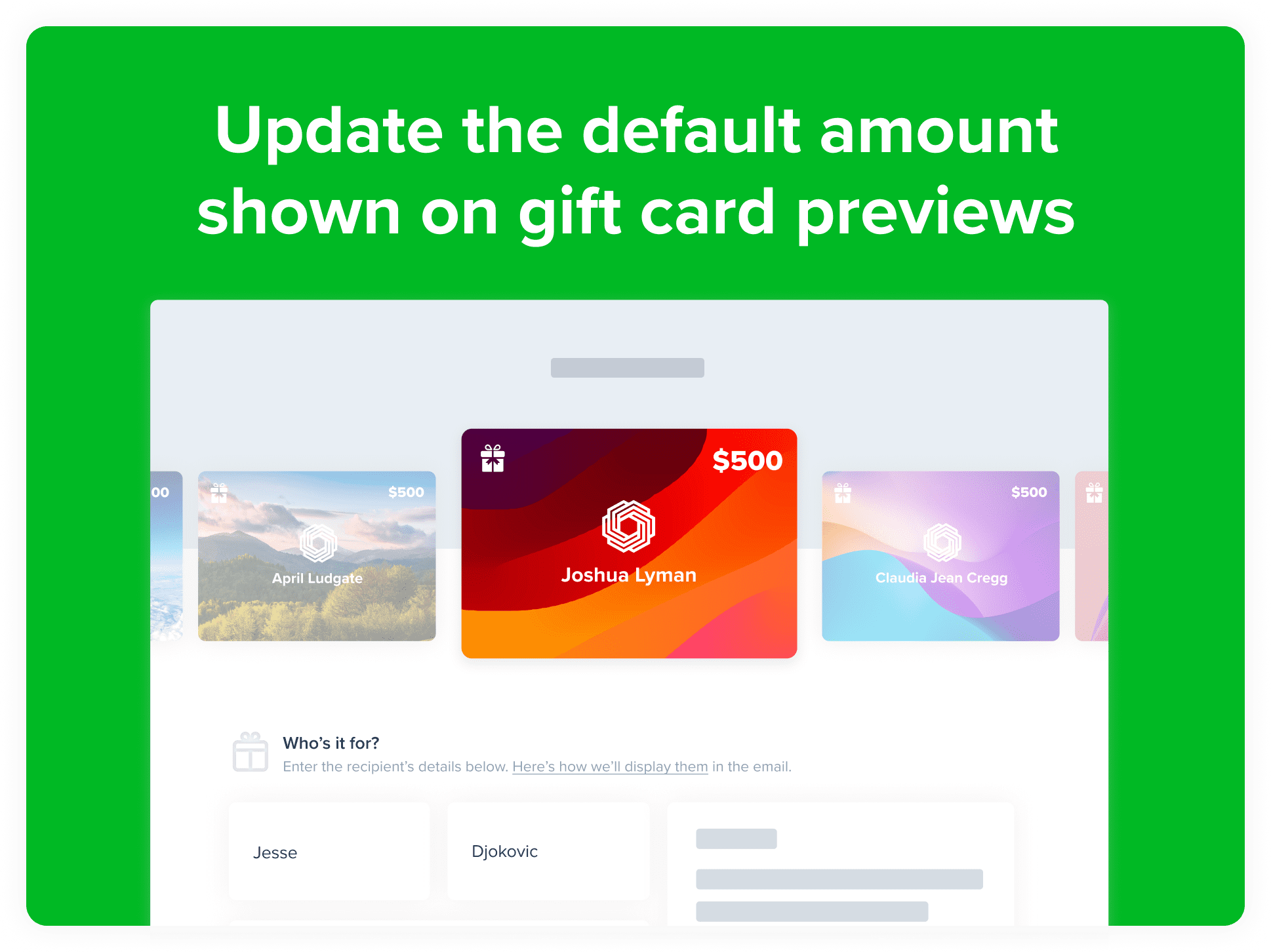

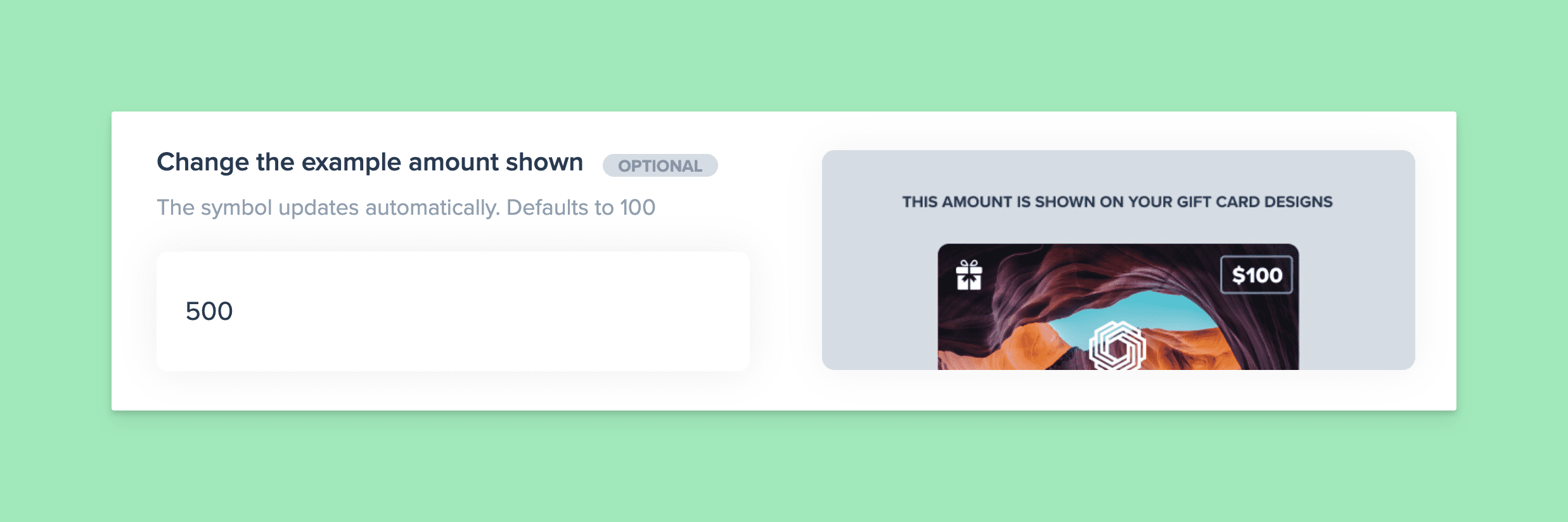

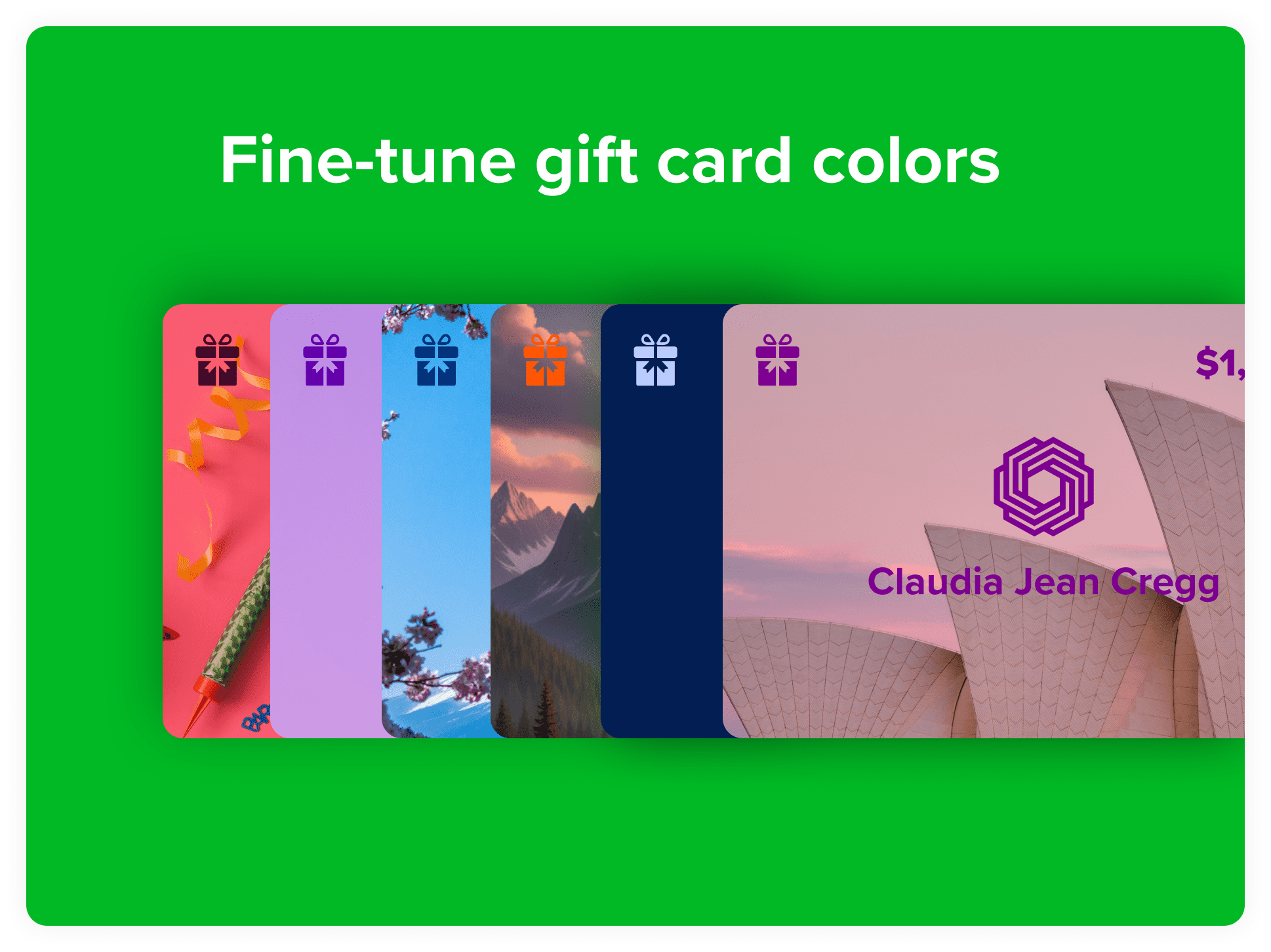

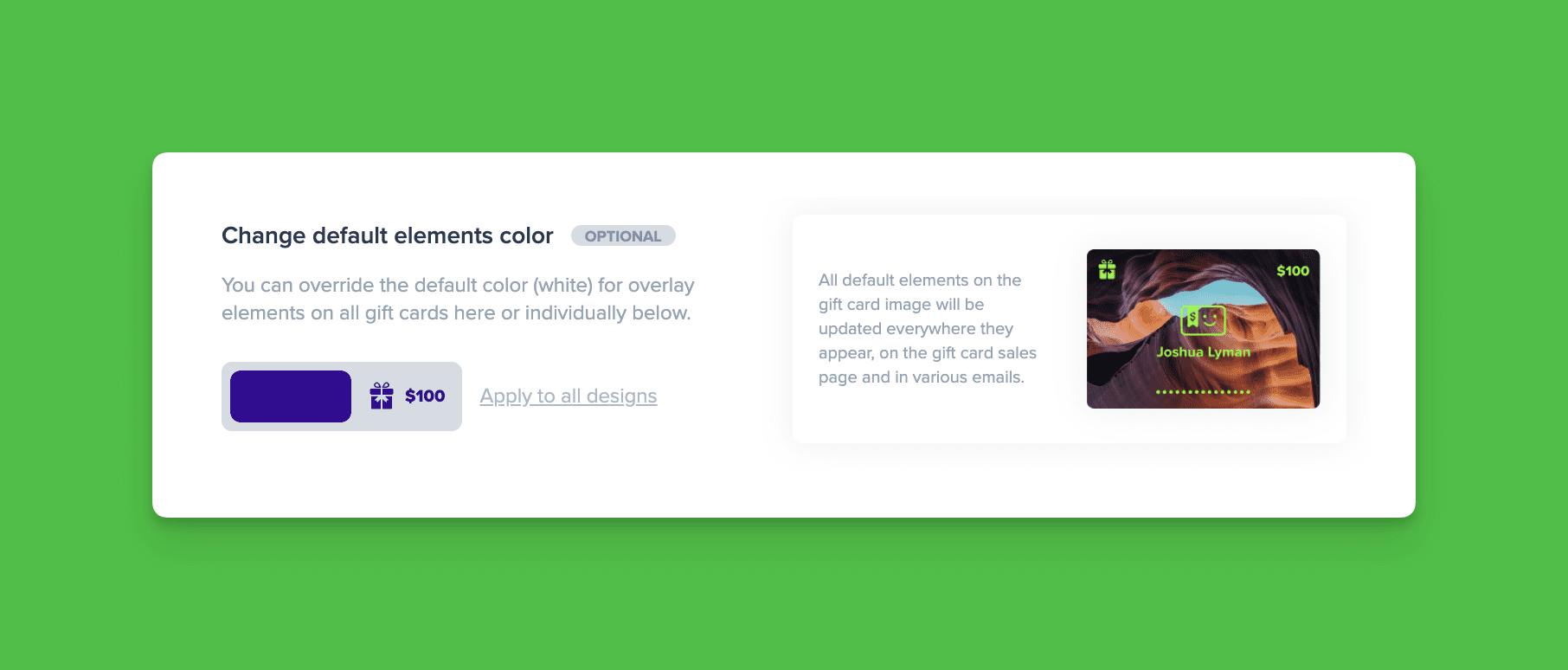

You’ll see some gift card settings you can adjust as needed and you can change these any time. Here you can add any custom terms, instructions on redeeming your gift cards, add your custom designs and more.

If you get stuck anywhere, just reach out to us via the chat icon – we’re happy to help with any setup as needed.

5. And you’re done! Share your gift card link with your customers, promote it on your site and your socials

Once you’re ready, Cardivo will generate a link for your gift card sales page. Here’s an example of what this looks like. Share your company’s link with your customers through your website, social media, WhatsApp, or anywhere your customers are. We recommend adding a banner to your site’s home page and adding a permanent link in your website’s menu or footer. Your customers will now be able to purchase your gift cards easily using a credit or debit card, Apple Pay, or Google Pay on any device, helping you sell more.

That’s it! If you’re interested in more country-specific laws governing gift cards, go here. Or if you’d like to offer your own gift cards in minutes using Cardivo, get started here.

Yes. For most types of gift cards, it is illegal for gift cards to expire or have an expiry date in California. This applies to businesses based in California or anyone selling gift cards to California residents. There are some exceptions where an expiry date can exist:

- Gift cards issued from loyalty, award, or promotional programs where no money or other thing of value is given in exchange – eg: if a customer makes 10 purchases and as a result is issued a $10 voucher, it can have an expiry date

- Gift cards used at multiple, unrelated sellers

- Cards issued in lieu of refunds for returned merchandise

- Gift cards sold in bulk below face value to an employer with a volume discount or those sold or donated to nonprofits below face value (as long as they expire within 30 days of sale)

- Gift cards for perishable food products.

For these exceptions, the expiration date must be printed in 10-point capital letters on the front. For digital gift cards, it must be clearly stated wherever the gift card is visible in emails or web pages.

Read more about all relevant California gift card laws here.

Only if the gift card value / balance is less than $10. For gift cards with a balance greater than $10, businesses have no obligation to cash them out. However, for gift cards with a balance less than $10, businesses must redeem them for cash (which includes cash, check or bank transfer) when requested by the gift card holder. It is illegal for businesses to refuse this.

Many large businesses have been caught out by this regulation and paid tens of hundreds of thousands in fines and penalties as a result.

Read more about this and other key California gift card laws here.

No. In most states, and under federal US law, companies cannot refuse to honor a gift card as long as it is valid and legal. In some states like California, adding an expiry date is illegal for most types of gift cards and under US federal law, gift cards must have a minimum 5 year expiration period. So if a gift card expiry period is stated as less than that, the company may still be legally obligated to honor it to comply with US federal law.

Even if a company has entered bankruptcy proceedings, it must honor any gift cards or provide a cash refund.

Read more about US federal gift card law here and California-specific gift card laws here (California is typically stricter and more consumer-friendly than federal law)

Key references and sources used for this article

https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=CIV§ionNum=1749.45.

https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=CIV§ionNum=1749.5.

https://codes.findlaw.com/ca/civil-code/civ-sect-1749-5/

https://www.fdic.gov/consumers/consumer/news/december2019.html

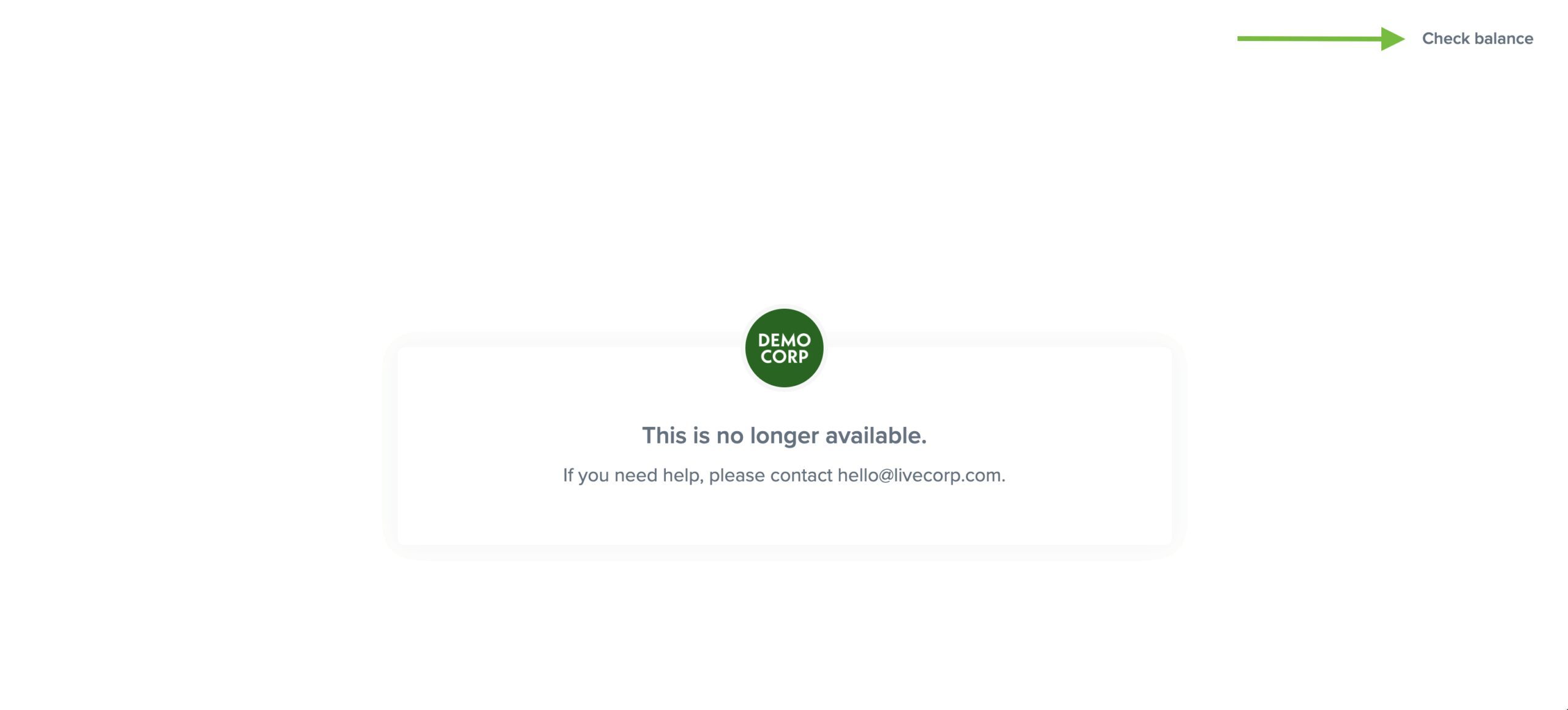

Gift card holders will still be able to access and click through to the “Check balance” link when the sales page is inactive. When you toggle it back on, your sales page will immediately start working again. This toggle has no impact on existing gift cards and their redemptions and those will continue to work. It just prevents new gift cards from being purchased.

Gift card holders will still be able to access and click through to the “Check balance” link when the sales page is inactive. When you toggle it back on, your sales page will immediately start working again. This toggle has no impact on existing gift cards and their redemptions and those will continue to work. It just prevents new gift cards from being purchased.